![]()

ISSN 2379-5980 (online) DOI 10.5195/LEDGER.2025.401

REVIEW ARTICLE

Development of the Blockchain Technology Literacy Test (BTLT): A Scoping Review of Current Literature

Lukas Weidener,† Bence Lukács ‡

Abstract. This study addresses the substantial gap in the academic literature on blockchain technology literacy by proposing a Blockchain Technology Literacy Test (BTLT). Through a comprehensive literature review of eight databases, only nine publications with limited focus on blockchain technology literacy were identified. The inconsistency in definitions and predominant emphasis on cryptocurrency literacy further complicate the development of standardized assessments. Based on the results of the literature review and the development of the BTLT, with a focus on terms and technological aspects, an updated list of cryptocurrency literacy questions was proposed as the Cryptocurrency Literacy Test (CLT) to avoid duplications and redundancy in the assessment of relevant blockchain technology and cryptocurrency-related knowledge. The BTLT and CLT aim to distinguish between blockchain technology and cryptocurrency literacy, thereby ensuring comprehensive and accurate assessments. The findings emphasize the need for clear definitions and frameworks within the blockchain ecosystem and call for expanded research to include emerging applications, such as DeFi, DeSci, DAOs, and Web3. This study provides a foundation for future educational efforts and literacy assessments in blockchain technology and cryptocurrencies.

![]()

† L. Weidener (lukas@weidener.eu) is a researcher at Molecule, Berlin, Germany.

‡ B. Lukács (bence.lukacs@iabc.dbuas.de) is a researcher at the Institute for Applied Blockchain, Berlin, Germany.

![]()

Blockchain technology, first conceptualized by Satoshi Nakamoto in 2008, has evolved significantly since the launch of the Bitcoin network in 2009.1 Bitcoin, the first decentralized cryptocurrency, introduced a new paradigm in digital finance by enabling peer-to-peer transactions without intermediaries.1 Over the years, blockchain technology has established itself as an emerging technology touching multiple different sectors as it expanded beyond Bitcoin to include a wide array of new blockchain protocols such as Ethereum.2 Among others, Ethereum enables advanced blockchain-based applications and extended features, such as smart contracts.2 These self-executing contracts with the terms of the agreement directly written into the code have facilitated the creation of Decentralized Autonomous Organizations (DAOs) and various forms of tokens, including utility, governance, and non-fungible tokens (NFTs).2, 3 Blockchain technology also facilitated the movement and concept of Decentralized Finance (DeFi), which is considered one of the most significant advancements in the field of blockchain technology and cryptocurrency.3 DeFi leverages blockchain technologies to offer financial services, such as lending, borrowing, and trading, without traditional intermediaries such as banks.3 This ecosystem is built on open protocols and decentralized applications, primarily the Ethereum blockchain, making financial services more accessible and transparent.2, 4 But this emerging technology is not only relevant for the financial sector: one of the most recent developments surrounds science and research (i.e., Decentralized Science; DeSci), where the use of the technology promises to democratize the access for funding under-valued research areas and increased transparency (in reaction to the “Replication Crisis”).5

In light of the rapid advancements in the above-mentioned areas and other emerging fields, the need for education on blockchain technology and its affordances has become increasingly important.6-8 Blockchain education is essential for providing individuals and organizations with the skills to understand, design, and implement decentralized technologies. As blockchains expand beyond finance into areas such as supply chain tracking in manufacturing and retail, secure handling of health records in healthcare, and transparent decision making in public governance, a knowledgeable workforce becomes indispensable. A well-educated workforce is thereby expected to drive innovation and enable solutions to the aforementioned challenges in fields such as logistics, healthcare and governance. Initiatives such as the European Union's CHAISE (“A Blueprint for Sectoral Cooperation on Blockchain Skill Development”) project underscore the importance of structured educational programs and skill development to ensure a competent workforce in this domain.6 However, because of the novelty of the technology and related uses, educational concepts have only recently started to move from implicit areas (i.e., computer science and cryptography) to more explicit ones (i.e., fundamental understanding of technological principles and socio-economic implications of blockchain technology; protocol engineering; smart contract development) when it comes to content and skill goals.9 Further, the current educational efforts often lack standardized methods for evaluating learners’ knowledge and skill in the first place.6, 7 This lack is reinforced through continued developments in public policy and the need for society to understand and actively participate in this emerging area. It is comparable to other historical technologies and areas emerging, where literacy development came to the forefront across a population, e.g., media/information literacy generally, as well as more specifically the digital realm for educators (“Digital Literacy Assessment”), or responses to climate change (“Climate Change Literacy Assessment”) and even more recently regarding the newest emerging technology (AI), which also includes literacy testing.10, 11

Most existing publications on blockchain education focus primarily on cryptocurrency literacy, which, although important, does not encompass the broader theoretical and practical aspects of blockchain technology necessary for comprehensive assessments.7 Nonetheless, initiating a discussion around the creation of robust educational frameworks and definitions is paramount in order to adequately address the diverse aspects of Blockchain technology. In order to properly engage with and assess current (and future) educational and training programs, a conceptual and theoretical foundation is necessary against which knowledge and skill development can be evaluated. Additionally, by developing a robust assessment framework the entire industry could be enabled to understand their business needs and hire the right employees. To advance the discourse on blockchain education, this study aims to contribute to the development of a foundational framework for assessing and advancing blockchain technology education.

The focus of this research is centered around blockchain technology broadly, which is considered the most well-known implementation of distributed ledger technology (DLT). As mapped by the European Union through the CHAISE project, there are currently approximately 350 related educational and training courses, which only underscores the need for a proper mode of assessment and evaluation, as the offerings range from engineering, to finance, to business, computer science as well as social sciences and encompass multiple different types of qualifications awarded.9, 12

While acknowledging the significant role and relevance of cryptocurrencies, this study aims to distinguish between blockchain technology and cryptocurrency. Discussing blockchain technology focuses on understanding the underlying technology and related terminology without direct ties to specific cryptocurrencies, such as Bitcoin. Although the importance of specific cryptocurrencies, such as Bitcoin, is recognized, cryptocurrencies should also be understood in light of technical specifications and terminology, such as being able to differentiate between coins (native currencies on their own blockchains) and tokens (which operate on existing blockchain protocols).<7

Setting this distinction first is critical for the further development of assessment and educational frameworks to ensure that learners can gain comprehensive knowledge that extends beyond simply the financial aspects of cryptocurrencies.8

2.1. Spot Trading AMMs—For this study, we have decided to adopt (use) the term “literacy” for our analysis, because it can represent a more widely understood starting point and can initiate further discussions. The concept or term “literacy”, although originally referring to the ability to read and write successfully, can be extended beyond to encompass the specific domain of knowledge and competencies needed to understand and interact with different forms of information.13 According to Budd (2015), information literacy, which can be considered relevant to blockchain technology literacy, requires a metacognitive approach in which individuals reflect on their understanding and use of information within specific contexts.14 Over time, literacy assessments have evolved from testing minimal reading and writing proficiency to measuring advanced cognitive and sociotechnical skills.15 This shift is a response to the proliferation of complex digital tools in professional and everyday life, which demands that individuals not only acquire domain-specific facts but also demonstrate the ability to transfer and apply knowledge across diverse contexts.16 Consequently, the underlying goal of modern literacy testing, whether in the financial, digital, or AI domains, is to determine how well learners adapt to new technologies and make informed decisions based on the skills they have acquired.17

AI literacy offers a relevant exemplar for blockchain technology literacy, as it is likewise centered on a single technology and intelligent systems, yet is being increasingly tested and documented in academia.15 While focusing on a specific technology, rather than an entire field of human activity, might limit the scope of literacy testing, recent systematic reviews emphasize the diverse skill sets that AI literacy demands, ranging from basic conceptual knowledge to advanced ethical judgment.17 Therefore, researchers are developing specialized assessment instruments to pinpoint whether individuals can meaningfully employ AI tools and reason about potential biases rather than relying solely on self-perceived competence.15 Focusing on a particular technology can refine our sense of what constitutes mastery, as it encourages targeted curricular interventions for both skill development and workforce readiness. By designing assessments that align test items with the demands of actual practice, such as evaluating AI-driven recommendations or managing potential algorithmic biases, educators can produce reliable and valid measures on how well individuals can navigate rapidly changing environments. Consequently, the construction of literacy tests has expanded to include robust measures of reliability and validity, ensuring that complex domains, whether AI, blockchain technology or beyond, are evaluated on credible scientific grounds.

In essence, literacy assessments today aim to capture both foundational understanding and the reflective capacity to adapt and apply knowledge in changing contexts.16 By aligning test questions with real-world demands, such as analyzing large datasets or evaluating algorithmic decisions, AI literacy tests exemplify how technology-specific assessments can reveal deeper levels of proficiency.17 This approach emphasizes that focusing on a particular technology does not narrow the scope of literacy testing; rather, it can sharpen the evaluation of essential metacognitive skills and domain-specific competencies that shape how individuals engage in various 21st-century environments.

2.2. Literacy in Blockchain Technology—In this study, “blockchain technology literacy” is understood as the comprehensive knowledge and skills required to navigate and utilize blockchain systems effectively. This includes understanding technological aspects and foundational terminology, such as the principles of decentralized networks, consensus mechanisms, and smart contracts.8 By grounding blockchain literacy in these broader theoretical foundations, this study aims to develop a nuanced understanding that can guide educational efforts and assessments in this field.7, 14

The foundational understanding of literacy in this study underscores the urgent need for adequate blockchain technology literacy testing frameworks, as exemplified by the aforementioned CHAISE initiative by the European Union.9 Although the educational significance of blockchain technology has been widely recognized, there remains a lack of robust assessment tools to support workforce development programs, evaluate readiness for specialized roles in the blockchain industry, and serve as benchmarks for designing targeted educational curricula. Furthermore, as blockchain technologies become increasingly integrated into everyday activities such as managing digital identities, participating in DAOs, or interacting with decentralized finance platforms, reliable assessment methods for blockchain technology literacy are essential to equip individuals with the foundational knowledge required to make informed decisions and effectively navigate these technological advancements.

Similar to how AI literacy frameworks have helped map domain‐specific competencies and inform targeted training, establishing robust methods for assessing blockchain technology literacy can directly benefit workforce planning and organizational readiness.10, 15, 16 Recent findings in AI suggest that well-validated instruments do more than measure technical proficiency; they also illuminate gaps in ethical judgment and preparedness for future job roles.17 Similarly, a reliable blockchain literacy assessment could serve as an anchor for policymakers seeking to cultivate digital skills at scale, whether through formal education, corporate learning initiatives, or public workforce development programs.18 By integrating such assessments into existing frameworks, institutions can systematically track the progression from foundational knowledge to more advanced competencies, such as smart contract security or decentralized governance. Furthermore, comparable to AI maturity models, industry standards for blockchain expertise could evolve around these assessment criteria, clarifying benchmarks for organizational preparedness and guiding reskilling pathways.

Based on this theoretical background, the primary objective of this research is to identify and synthesize current literature on blockchain technology literacy, including associated concepts, to develop a comprehensive blockchain technology literacy test (BTLT).

Given the theoretical foundation distinguishing blockchain technology literacy from cryptocurrency literacy, the secondary objective of this research is to provide an updated cryptocurrency literacy test. This aims to reduce redundancy, ensuring that each test accurately reflects specific knowledge relevant to its domain.

The methodological foundation for this research adhered to the PRISMA-SCR (Preferred Reporting Items for Systematic reviews and Meta-Analyses extension for Scoping Reviews) guidelines for scoping reviews.19 To identify relevant literature, a comprehensive search was conducted across eight databases: ScienceDirect, Scopus, JSTOR, Google Scholar, Web of Science, IEEE Xplore, arXiv, and Social Science Research Network (SSRN). The search period was limited to 16 years (2008 - 2024), with the 2008 terminus post quem being derived from the publication date of the Bitcoin whitepaper.1

No scoping review protocol has been published prior to this study. Ethical approval was deemed inapplicable because of the theoretical nature of this study.

4.1. Selection Criteria—To identify relevant literature, a keyword search was conducted across the eight selected databases. The following keywords were used in combination with Boolean operators (AND, OR) to narrow down the search results: Bitcoin; blockchain education; blockchain literacy; blockchain technology; consensus mechanisms; cryptocurrency; cryptocurrency literacy; decentralization; DAO; decentralized finance (DeFi); DeFi; distributed ledger technology; distributed ledger technology (DLT); DLT; education frameworks; Ethereum; literacy; literacy assessment; NFT; NFTs; public ledger; skills; skills development; smart contracts; terminology; token; tokens; understanding; and Web3. The keywords were derived from the research objectives and further refined through a preliminary literature search to ensure a comprehensive coverage of the relevant literature. Synonyms, abbreviations, and variations were incorporated to account for the different terminologies used across disciplines and regions, thereby enhancing the inclusivity and accuracy of the search. The keywords were also iteratively refined based on the results of the preliminary searches to ensure their relevance and inclusivity. Only English-language publications with accessible abstracts were included. Given the novelty of blockchain technology and its related concepts, preprint publications were also considered.

The search results were imported to Mendeley (Elsevier) to remove duplicates. During the selection process, the titles and abstracts were screened for relevance. Publications that passed this initial screening were subjected to a full-text review to assess their suitability. Only publications that addressed the study objective and demonstrated thematic relevance were included.

4.2. Test Development Process—The questions were selected based on the objectives of this study to develop a comprehensive literacy assessment that addresses the foundational, technical, and application-based aspects of blockchain technology. Questions that were newly developed or adapted (i.e., not directly adopted without changes from identified and relevant publications) were drafted by the research team. The authors have advanced academic qualifications, including graduate education in blockchain technology and education, as well as significant practical experience in research and professional roles focused on blockchain education and technology. Their expertise includes active contributions to research on educational methodologies in technology-related fields, full-time positions in the blockchain industry, and education. The developed set of questions was reviewed by two blockchain experts (a senior blockchain engineer and a chief technology officer for blockchain protocol development), each with over five years of experience in blockchain system design and implementation. Their feedback refined the questions to ensure practical relevance, alignment with technological advancements, and effective assessment of both foundational knowledge and advanced competencies. The question development process also involved iterative refinement to enhance clarity, relevance, and alignment with the study objectives, resulting in a comprehensive and accessible final set.

4.3. Data Extraction and Analysis—Data from all identified publications was extracted using Microsoft Excel (version 16.78). For each publication, the extracted data included the title, year of publication, author(s), methodological details, and key findings. The collected data was then subjected to thematic synthesis to identify common themes and concepts, thereby facilitating a comprehensive analysis of the literature on blockchain technology and cryptocurrency literacy.

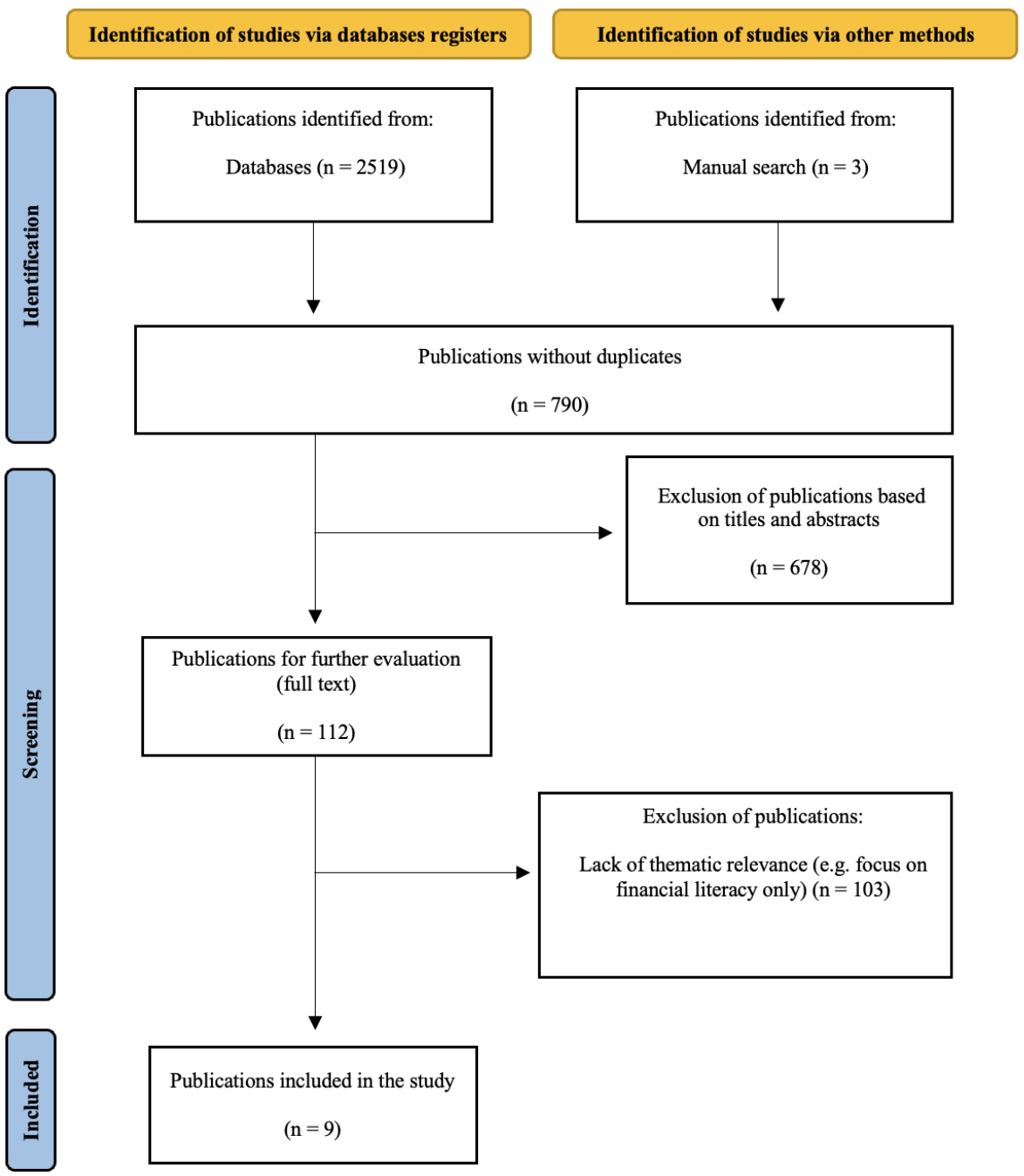

The literature review conducted across eight databases over a 16-year period (2008–2024) resulted in the identification of 2,519 publications. An additional 3 publications were identified through manual search and included in the selection process. After the removal and exclusion of 1,732 duplicates, the titles and abstracts of 790 publications were evaluated. The evaluation of the titles and abstracts led to the exclusion of 678 publications. Consequently, the full texts of 112 publications were assessed, resulting in the exclusion of 103 publications due to a lack of thematic relevance. Ultimately, 9 publications were included in this study. An overview of the literature review search and selection process is presented in Figure 1.

Fig. 1. Flow chart of the publication identification and evaluation process adapted from the PRISMA-SCR guidelines.19 |

5.1. Publication Characteristics—All identified publications were published within the last six years (2019: n = 1; 2020: n = 1; 2021: n = 1; 2023: n = 3; 2024: n = 3). Notably, none of the identified publications specifically focused on blockchain technology literacy. Instead, blockchain technology-related literacy was indirectly addressed as part of the cryptocurrency literacy questions or corresponding answers. Detailed information on the nine included publications is presented in Table 1.

Table 1. Detailed information on the identified and evaluated publications. |

|

Title |

Methodology |

Key Findings |

|

Jones et al., Measuring Cryptocurrency Literacy (2024) 20 |

Quantitative survey with 501 participants. Sixteen questions on cryptocurrency literacy. |

Higher Cryptocurrency Literacy Scale (CLS) scores correlate with longer ownership and more frequent learning. Cryptocurrency literacy distinct from general financial literacy. CLS includes aspects of blockchain technology literacy. |

|

Jones et al., The Interdependence of Financial Literacy and Crypto Literacy (2024) 21 |

Quantitative survey with 338 participants. Five questions on cryptocurrency literacy. |

Positive relationship between crypto and financial literacy. Crypto literacy influences optimistic views on Bitcoin's future prices. Questions included aspects of blockchain technology literacy. |

|

Colombo & Yarovaya, Are Crypto and Non-Crypto Investors Alike? Evidence from a Comprehensive Survey in Brazil(2024) 22 |

Quantitative online survey with 573 Brazilian digital platform investors with one question on cryptocurrency literacy. |

Cryptocurrency investors are younger, more risk-tolerant, less optimistic about the real economy, and predominantly male. Significant heterogeneity among investors. Questions included aspects of blockchain technology literacy. |

|

Wen & Hongchingdaket, Interviewing Young Adults about Cryptocurrency Literacy and Investment Intention (2023) 23 |

Qualitative semi-structured interviews with 16 participants (ages 18-20) in Thailand, Japan, and the Philippines. |

Lack of basic cryptocurrency literacy among young adults. Barriers include lack of education, market perception, and negative reputation. Only two respondents had basic knowledge of blockchain technology. |

|

Balutel et al., Crypto and Financial Literacy of Cryptoasset Owners Versus Non-Owners: The Role of Gender Differences (2023) 24 |

Theoretical analysis of secondary data from the Bank of Canada’s Bitcoin Omnibus Survey (BTCOS). |

Women performed worse than men on cryptocurrency literacy. Positive correlation between cryptocurrency and financial literacy. Only three questions on cryptocurrency literacy, indirectly covering aspects of blockchain technology. |

|

Khan, Literacy, Profile, and Determinants of Bitcoin, Ethereum, and Litecoin: Survey Results (2023) 25 |

Quantitative online survey with 257 university students from two Malaysian universities. Six questions each on Bitcoin, Ethereum, and Litecoin literacy. |

Higher knowledge of Bitcoin compared to Ethereum and Litecoin. High cryptocurrency literacy cluster had higher levels of financial knowledge and education. Survey partially covered aspects of blockchain technology literacy. |

|

Hidajat et al., Measuring Bitcoin Literacy in Indonesia (2021) 26 |

Literature review and interviews with Bitcoin academics, traders, and investors. Focus group discussion. Number of interviews not specified. |

Foundational framework for assessing basic Bitcoin literacy. Emphasizes the need for a standardized tool to measure Bitcoin literacy. Aspects of blockchain technology literacy partially covered. |

|

Khasanovich et al., Case Study of Youth Financial Literacy in the Field of Cryptocurrency Use (2020) 27 |

Quantitative data collection from 362 participants. Four questions on cryptocurrency literacy. |

Majority of respondents were aware of cryptocurrency but had limited detailed knowledge. Educational initiatives, such as special centers and TV programs, could improve financial literacy among youth. Questions included aspects of blockchain technology literacy. |

|

Bannier et al., The Gender Gap in ‘Bitcoin literacy’ (2019) 28 |

Theoretical analysis based on secondary data from the Understanding America Study. Sample of 2,533 participants with six true/false questions on Bitcoin literacy. |

Women found to possess weaker Bitcoin knowledge than men. Financial literacy measures accounted for approximately 40% of the gender gap. Indirect coverage of blockchain technology aspects. |

Two publications were authored by the same authors.20, 21 The majority of identified publications used quantitative data collection methodologies (n = 5).20, 21, 22, 25, 26 Additionally, two studies employed qualitative data collection approaches,20, 23 whereas the remaining two centered on theoretical analysis.24, 28

5.2. Blockchain Technology Literacy—Although none of the identified publications specifically focused on blockchain technology literacy, the information provided on cryptocurrency literacy includes valuable information on blockchain technology literacy, following the theoretical foundation of this study. Emphasizing the technology itself without direct ties to specific cryptocurrencies, such as Bitcoin or Ethereum, information from the nine publications was synthesized and adapted to reflect the theoretical focus of this study. Consequently, 15 multiple-choice questions were defined to form a proposed Blockchain Technology Literacy Test (BTLT) aimed at comprehensively assessing knowledge and skills related to the terminology and technical aspects of blockchain technology. The complete BTLT, with multiple-choice answer options for each question, is provided in Appendix (A1). Table 2 provides an overview of the defined and adapted BTLT questions.

It should be noted that, given the varying focus on blockchain technology literacy and the predominant focus on cryptocurrency in the included publications, the resulting questions are not solely adapted from the provided questions. Instead, BTLT questions are derived from some of the answers to the cryptocurrency literacy questions provided in the publications.

The first question, “What is a blockchain?” aims to ensure that respondents understand the basic definition and key characteristics of blockchain technology, and was included from the “Measuring Cryptocurrency Literacy” publication without changes.20 The second question, focusing on decentralization and distributed control, “What does decentralization mean in the context of blockchain technology?” was developed based on the question “Explain what decentralized means,” which was suggested by one of the interviewed cryptocurrency owners in the same publication.20

Similarly, the concept of a public ledger, addressed in “What is a public ledger in the context of blockchain technology?” (Q3), is adapted from the proposed question on cryptocurrency literacy “What is a ledger?”.20 To assess knowledge on consensus mechanisms, which are fundamental to blockchain technology, two new questions are proposed: “How is data added to a blockchain?” (Q4) and “What is the purpose of a consensus algorithm for a blockchain?” (Q5).

Question six, focusing on the purpose of nodes in a blockchain network, was also derived from one of the suggestions from cryptocurrency owner interviews (“Include some questions about nodes and mining”) in the publication “Measuring Cryptocurrency Literacy”.20 The question “What is a smart contract?” (Q7) is proposed as a new question given the importance of smart contracts for blockchain technology and its applications. Hash functions, another critical component of blockchain technology, are addressed by the newly proposed question “What is a hash function in the context of blockchain technology?” (Q8), focusing on the cryptographic aspect and purpose of hash functions to ensure data integrity and security.

Table 2. Proposed blockchain technology literacy test (BTLT) questions. |

|

Question (Q) |

Explanation |

|

|

Q1: What is a blockchain? |

Included without changes 20 |

|

|

Q2: What does “decentralization” mean in the context of blockchain technology? |

New question adapted from (20) |

|

|

Q3: What is a public ledger in the context of blockchain technology? |

New question adapted from (20) |

|

|

Q4: How is data added to a blockchain? |

New question |

|

|

Q5: What is the purpose of a consensus algorithm for a blockchain? |

New question |

|

|

Q6: What is the primary purpose of a node in a blockchain network? |

New question adapted from (20) |

|

|

Q7: What is a smart contract? |

New question |

|

|

Q8: What is a hash function in the context of blockchain technology? |

New question |

|

|

Q9: Which consensus mechanism does not require computational power? |

New question adapted from (20) |

|

|

Q10: What is a private key in blockchain technology? |

New question adapted from (20, 21) |

|

|

Q11: What is a fork in the context of blockchain technology? |

New question |

|

|

Q12: What is the role of mining in blockchain technology? |

New question adapted from (26, 27) |

|

|

Q13: What is a permissioned blockchain? |

New question |

|

|

Q14: What is the “Byzantine Generals Problem”? |

New question |

|

|

Q15: What is a Merkle Tree? |

New question |

The differentiation between consensus mechanisms, such as proof-of-work and proof-of-stake, is addressed in “Which consensus mechanism does not rely on computational power to validate transactions?” (Q9), which was adapted from the “Measuring Cryptocurrency Literacy” publication.20 Question ten, “What is a private key in blockchain technology?” was developed based on recurring mentions in two of the nine publications with the aim of assessing the role and importance of private keys in blockchain security.20, 21

The question “What is a fork in the context of blockchain technology?” (Q11) was newly proposed as part of the BTLT to cover the concept of network splits and more advanced technical details. Question 12, focusing on the role of mining, “What is the role of mining in blockchain technology?” (Q12) was derived from recurring mentions in different publications.20, 26, 27 Questions such as “What is a permissioned blockchain?” (Q13) and “What is the “Byzantine Generals Problem”?” (Q14) address more specific technical aspects and challenges within blockchain networks and are proposed as new questions. Finally, “What is a Merkle Tree?” (Q15) covers a fundamental data structure used for efficient and secure verification of data in prominent blockchain protocols, such as Bitcoin or Ethereum, and is also proposed as a new question for the BTLT.

5.3. Cryptocurrency Literacy—Following the theoretical foundation of this research and the definition of blockchain literacy questions, an updated list of questions related to cryptocurrency literacy was created to reduce redundancy and ensure a comprehensive assessment of knowledge related to cryptocurrency. Similar to the BTLT, the focus remains on the technology and terminology of cryptocurrencies. Based on the publications focusing on cryptocurrency literacy identified in the literature review, 15 multiple-choice questions are proposed. Table 3 provides an updated list of cryptocurrency literacy questions, referred to as the Cryptocurrency Literacy Test (CLT). The complete CLT, with multiple-choice answer options for each question, are provided in the Appendix (A2).

The first question of the CLT, “What is a cryptocurrency?” (Q1), is proposed as a new question to assess fundamental knowledge of cryptocurrencies, as a comparable question was absent in the identified and evaluated publications. Similarly, question two, “What is a coin in the context of cryptocurrency?” and question three, “What are tokens in the context of cryptocurrency?” aim to assess the fundamental knowledge of the terms and technicalities of cryptocurrencies. Both questions were derived from the “Measuring Cryptocurrency Literacy” publication, where cryptocurrency owners were interviewed to identify potential questions on cryptocurrency literacy (e.g., “I would ask about the difference between coins and tokens”).20 The same applies for question four, “What does NFT stand for?”, that aims to extend the concept and understanding of tokens, which was derived from two of the proposed questions (“What is an NFT?” and “What does NFT stand for?”).20

Given the importance of tokens for the current cryptocurrency landscape, two new questions are proposed to further assess related knowledge: “What are governance tokens?” (Q5) and “What are utility tokens?” (Q6). The question “What are stablecoins?” (Q7) was adapted from “Measuring Cryptocurrency Literacy,” where a similar question is part of the developed cryptocurrency literacy assessment (“How do stablecoin issuers typically claim to maintain a stablecoin’s value?”) and generalized for the CLT (20). Question eight, “Which of the following is true about Bitcoin and Ethereum?” was included from the same publication without changes, acknowledging the importance of both Bitcoin and Ethereum while highlighting the decentralized verification process using peer-to-peer networks.20

Table 3. Proposed cryptocurrency literacy test (CLT) questions. |

|

Question (Q) |

Explanation |

|

|

Q1: What is a cryptocurrency? |

New question |

|

|

Q2: What is a coin in the context of cryptocurrency? |

New question adapted from (20) |

|

|

Q3: What are tokens in the context of cryptocurrency? |

New question adapted from (20) |

|

|

Q4: What does NFT stand for? |

New question adapted from (20) |

|

|

Q5: What are governance tokens? |

New question |

|

|

Q6: What are utility tokens? |

New question |

|

|

Q7: What are stablecoins? |

New question adapted from (20) |

|

|

Q8: Which of the following is true about Bitcoin and Ethereum? |

Included without changes 20 |

|

|

Q9: What are transaction fees in the context of cryptocurrency? |

New question |

|

|

Q10: Which of the following best describes the nature of Bitcoin transactions? |

Included without changes 20 |

|

|

Q11: Who confirms that a Bitcoin transfer is valid? |

Included without changes 20 |

|

|

Q12: What is the smallest denomination of Bitcoin called? |

New question adapted from (26) |

|

|

Q13: Which of the following is true about central bank digital currencies (CBDC)? |

Included without changes 20 |

|

|

Q14: What is a Centralized Exchange (CEX)? |

New question |

|

|

Q15: What is a Decentralized Exchange (DEX)? |

New question |

Question nine, “What are transaction fees in the context of cryptocurrency?” is a newly proposed question that focuses on the costs associated with processing and validating transactions, given the absence of similar questions in the evaluated publications. The following two questions, “Which of the following best describes the nature of Bitcoin transactions?” (Q10), which discusses the semi-anonymous nature of transactions and the potential for traceability through blockchain analysis, and “Who confirms that a Bitcoin transfer is valid?” (Q11) were included without changes from one of the identified and evaluated publications on cryptocurrency literacy.20 Question 12, “What is the smallest denomination of Bitcoin called?” focuses on the smallest denomination of Bitcoin, which aims to assess more advanced cryptocurrency-related knowledge and was derived by one of the statements (“Satoshi is the smallest Bitcoin unit recorded on the Bitcoin Blockchain network.”) from “Measuring Bitcoin Literacy in Indonesia”.26

The question about central bank digital currencies (CBDCs), “Which of the following is true about central bank digital currencies (CBDC)?” (Q13) was included without any changes from one of the evaluated publications.20 As understanding the differences between centralized and decentralized exchanges can be considered important in the context of cryptocurrencies, two new questions are proposed: “What is a Centralized Exchange (CEX)?” (Q14) and “What is a Decentralized Exchange (DEX)?” (Q15) given the lack of similar questions in the evaluated publications.

The exploration of blockchain technology literacy reveals a substantial gap in academic literature, highlighting the critical need for focused educational assessments and tools. Despite the increasing recognition of the potential of blockchain technology, there remains a notable scarcity of publications specifically dedicated to evaluating blockchain education generally, and blockchain/cryptocurrency literacy specifically.

This shortfall could be attributed to several interrelated factors. The inconsistency in definitions across blockchain technology, cryptocurrency, and related applications, such as DAOs, DeFi and DeSci, complicates the development of standardized literacy assessments. Academic discourse often conflates blockchain technology with its applications, such as cryptocurrencies such as Bitcoin and Ethereum, rather than treating them as distinct, yet interrelated domains.4 Clear distinctions are hindered by the common practice of using terms such as Bitcoin and Ethereum to refer both to cryptocurrencies and their underlying blockchain protocols. This conceptual ambiguity poses a broader challenge because evolving definitions and frameworks hinder the creation of effective assessment tools for blockchain literacy.29 Moreover, the novelty of blockchain technology as an emerging field has contributed to the limited availability of academic resources.30 Blockchain technology and its applications have only recently received scholarly attention.31 This recency means that research is still in its formative stages, accounting for the current lack of comprehensive educational resources and assessments.31 This lag is compounded threefold: firstly, by the slow pace of academic publishing, delaying dissemination of new research findings, and hindering the development of educational materials; secondly, by the current lack of interdisciplinary collaboration with educational and learning sciences, where discussions around “Literacy” as well as relevant skills and competencies have not penetrated the field of Blockchain technology; and finally, by the (understandable) impatience of businesses and industry who would rather develop valid assessment and evaluation criteria for their own employees and needs.8 This is additionally surprising when considering other fields, businesses and technologies that necessitated literacy testing in order to understand human functioning and potentially assess expertise.

The skepticism surrounding cryptocurrencies and blockchain technology also limits academic engagement. Concerns about volatility and regulatory uncertainties may deter institutions from committing resources to blockchain education.4 This skepticism is reflected in the cautious approach of educational programs, where the development and adjustment of new and current curricula necessitates a thorough evaluation and assessment process (of the content, or rather the competencies and learning outcomes intended) beforehand.32 There are also often delays due to lengthy accreditation processes and challenges in developing new curricula for emerging technologies.8, 33 Additionally, the lack of focus on specific applications, such as DAOs and DeFi, in the existing literature underscores a broader issue: fragmentation of the broader blockchain-related field. No assessments of DAOs or DeFi literacy were identified in the literature review, revealing a significant gap in the academic exploration of these advanced concepts. This gap highlights an opportunity for future research to address the literacy needs within blockchain ecosystems.

6.1. The Blockchain Technology Literacy Test (BTLT)—Following a comprehensive literature review, 15 questions were defined as part of the BTLT. However, it is important to note that no identified publications have specifically focused on blockchain technology literacy under the theoretical foundation of this research. While some aspects of the identified cryptocurrency literacy concepts and questions could be considered relevant to blockchain technology literacy, the absence of explicit information necessitated the formation of new questions. The limited focus on cryptocurrency literacy in the included publications is a contributing factor to the lack of relevant information. Some publications provide extensive research on cryptocurrency literacy,20 while others feature only a single question on the topic.22 This inconsistency underscores the challenge of developing a comprehensive literacy test that addresses the nuances of blockchain technology separately from those of cryptocurrencies.

In the absence of extensive academic literature on blockchain technology literacy, it is essential to consider non-academic sources of information. For example, the “Crypto Literacy Quiz” considered itself as “an industry resource for assessing and advancing the education and awareness of cryptocurrency around the world.”34 Some questions from this quiz align with the concept of blockchain literacy defined in this research. Examples include “What is a blockchain?”, “The smallest unit of a dollar is called a cent. What is the smallest unit of bitcoin called?”, “What is a Non-Fungible Token (NFT)?”, and “What is a node?”. Although phrasing and answers differ, these questions provide valuable insights into blockchain technology literacy. Given that these questions of the “Crypto Literacy Quiz” aim to assess cryptocurrency rather than blockchain technology literacy, it further emphasizes the strong need for clear distinctions between both concepts and consistency in the definitions of relevant terms. Establishing such distinctions is crucial for developing effective educational assessments and ensuring that learners acquire a comprehensive understanding of blockchain technology, independent of cryptocurrency-specific knowledge.

The lack of literature specifically addressing blockchain technology literacy also warrants contextualization of the BTLT regarding blockchain technology-related educational efforts and courses. Upon exploration of recent publications, the BTLT is well-aligned with the existing efforts in blockchain education, addressing “fundamental concepts such as distributed ledger technology, consensus mechanisms, cryptographic principles, and smart contracts”.6 Questions such as “What is the purpose of a consensus algorithm in blockchain?” (Q5) or “What is a smart contract” (Q7) exemplify the alignment with the CHAISE initiative.6

Furthermore, a systematic literature review of blockchain for higher education underscores the importance of technical aspects, such as consensus mechanisms and smart contracts. The BTLT question “What is a hash function in the context of blockchain technology?” (Q8) directly addresses the cryptographic foundations of blockchain, a critical aspect for its application in educational contexts, as highlighted in the review.30 Questions on decentralization and the roles of nodes, such as “What does ‘decentralization’ mean in the context of blockchain technology?” (Q2) and “What is the primary purpose of a node in a blockchain network?” (Q6) reflect the educational modules described in the blockchain education literature.6, 30, 33 These modules emphasize the understanding of decentralized systems, which is a foundational element of blockchain technology that is necessary for various applications and practical use.

6.2. The Cryptocurrency Literature Test (CLT)—Following the definition of the BTLT, an updated list of cryptocurrency literacy questions, termed the CLT, was proposed to avoid duplication and to provide an assessment focusing on the technicalities and terminology of cryptocurrency. Given the limited focus on cryptocurrency literacy in some identified publications, which often emphasize financial literacy and its correlating effects, most questions for CLT were derived from the recent publication “Measuring Cryptocurrency Literacy”.20 During the analysis of the included publications, it became evident that many emphasized the financial aspects of cryptocurrencies rather than a technical understanding or knowledge of relevant terms. For instance, various publications have included questions focusing on specific cryptocurrencies, such as Bitcoin, as part of their assessment.20, 21, 24, 25, 26, 28 In fact, two of the publications identified in the literature review specifically focused on Bitcoin.23, 25 These publications were included because of the limited availability of relevant literature and because the questions also covered aspects related to blockchain technology and cryptocurrency literacy. For example, the true-false statement “Satoshi is the smallest Bitcoin unit recorded on the Bitcoin Blockchain network” was rephrased as a new question in the CLT.26

Interestingly, while some questions on cryptocurrency terminology were proposed in the “Measuring Cryptocurrency Literacy” publication from the interviewed cryptocurrency owners, no questions regarding the definition and terminology of cryptocurrencies, coins, or tokens were identified in the evaluated publications as part of the proposes testing modalities. Given the existing uncertainties surrounding terminology, these questions were specifically proposed and added to the CLT to address this problem. Although more publications regarding cryptocurrency literacy have been identified compared to blockchain technology literacy, the varying focus on financial literacy highlight the importance of non-academic sources of information. Similar to the BTLT questions, the questions from the “Crypto Literacy Quiz” resemble some of the CLT questions.34 For example, the question “What is the name for digital currencies that link their value to an underlying asset such as national currencies or precious metals?” is comparable to question seven of the CLT, “What are stablecoins?”.30

During the analysis of the “Crypto Literacy Quiz” questions, it became evident that the quiz hasn't been updated recently, exemplified by questions such as: “Ethereum, the second-largest cryptocurrency, changed from using proof-of-work to proof-of-stake in September. What’s one big reason why?”.34 Although the importance of Ethereum and the event is acknowledged, this event occurred in September 2022, indicating a lack of recency in question formulation.35Furthermore, the question “Which of the following statements best describes decentralized finance, also known as DeFi?” from the “Crypto Literacy Quiz” highlights the perceived close relationship between cryptocurrency, decentralized finance, and financial literacy concepts, which were also evident in some of the included and evaluated academic publications.21, 23, 24, 27 For example, the question “What is the formula for calculating a cryptocurrency’s market capitalization?” from one of the included publications exemplifies the lack of a clear distinction between literacy concepts, as knowledge of market capitalization is often associated with financial literacy rather than technical details of cryptocurrencies.20

This analysis underscores the strong need for further research into specific blockchain-related areas, such as DeFi, Web3, or DAO Literacy, which could not be identified in the literature review. This indicates the need for more targeted educational resources and assessments to better differentiate and address the nuances of various blockchain-related technologies and concepts. In addition to exploring specific areas such as DeFi, Web3, or DAO Literacy, future research should also consider establishing a framework for the periodic review and revision of literacy tests such as the BTLT and CLT. This ensures that the content remains aligned with the ongoing technological advancements and emerging applications. Such a framework could outline the criteria and processes for identifying new concepts, refining outdated questions, and incorporating stakeholder feedback to maintain the relevance and efficacy of these assessments.

6.3. Rationale and Implications of the BTLT—Recent developments have underscored the potential rationale and implications of blockchain literacy frameworks. Although formal literacy tests often focus on activities where the general public faces immediate risk (e.g., financial borrowing or consumer investments), a rapid expansion of blockchain technology and subsequent educational needs is expected.6-8 Nonetheless, literacy tests are often criticized, especially if applied to fast-evolving technologies such as blockchain technology, because emerging blockchain technology applications can differ significantly in scope and complexity.7, 8 Different blockchain use cases, whether DeFi or supply chain verification, may demand unique forms of competence that a single test format cannot fully capture.

However, emerging regulatory guidelines have begun signaling the need for demonstrable competence in blockchain and crypto-asset knowledge, particularly in professional settings. For instance, the European Securities and Markets Authority (ESMA) has issued a public consultation on knowledge and competence guidelines under the Markets in Crypto-Assets (MiCA) Regulation.36 These guidelines seek to ensure that personnel providing advice or information about crypto-asset services meet minimum standards related to DLT fundamentals and risk factors.36 Although these proposals target professional advisors, they emphasize the requirement for formal blockchain technology-related competencies, which necessitate literacy assessments. Such regulatory contexts broaden the scope of the BTLT, reinforcing the need for a comprehensive blockchain technology literacy assessment instrument that spans curriculum design, industry training, and regulatory compliance.

6.4. Limitations—Only nine publications were included, reflecting the limited scope with only limited focus on blockchain technology literacy. The inclusion criteria were restricted to studies published in English, which may have resulted in the exclusion of relevant studies in other languages. The search strategy was constrained by the selection of keywords and databases, which possibly omitted pertinent studies. Only academic publications were considered in the main analysis, thereby potentially overlooking insights from non-academic sources and industry-led initiatives. Subjective judgment during the selection and analysis processes may have introduced a bias. Furthermore, the absence of clear and widely accepted definitions of cryptocurrencies and blockchain technology complicates the interpretation and may contribute to inconsistencies in the findings. These limitations highlight the need for broader and more inclusive research methodologies in the future.

This study highlights substantial gaps in the academic literature on blockchain technology literacy, underscoring the need for focused educational assessments and resources. Considering the rapid evolution and growing importance of blockchain technology, current research is often fragmented and lacks a comprehensive coverage of blockchain literacy, with a predominant focus on cryptocurrency literacy while dealing with increased demands for workforce development. The Blockchain Technology Literacy Test (BTLT) and the updated Cryptocurrency Literacy Test (CLT) aim to fill this gap by providing comprehensive and targeted assessment modalities. These tools distinguish between blockchain technology and cryptocurrency literacy by focusing on the technical aspects and terminology of each domain. This research emphasizes the importance of establishing clear definitions and frameworks within the blockchain-related ecosystem to facilitate effective education and literacy assessments. By developing a literacy framework, future workforce and skills assessment can benefit from an educational scientific foundation and support in developing standards for the industry.

The next steps for this development are the validation and testing of the framework first in explicit blockchain education initiatives (e.g., universities and training) and secondly gathering feedback from the industry to match the skills need of the future workforce. Additionally, expanding the scope of blockchain literacy to encompass emerging applications such as DeFi, DAOs, DeSci, and Web3 is crucial to ensure that educational programs evolve in step with technological advancements.

The authors received no financial support for the research, authorship, and/or publication of this article.

The authors hold direct and indirect investments in several cryptocurrency and blockchain-related projects.

A preprint of this submission has been published on TechRxiv:

Lukas Weidener, Bence Lukács. "Development of the Blockchain Technology Literacy Test (BTLT): A Scoping Review of Current Literature." TechRxiv. 6 September 2024. https://www.techrxiv.org/users/826665/articles/1221684-development-of-the-blockchain-technology-literacy-test-btlt-a-scoping-review-of-current-literature

Both authors contributed equally to the preparation and revision of the manuscript. LW led the methodological implementation and data analysis (70%), with support from BL (30%).

BTLT: Blockchain Technology Literacy Test

CBDC: Central Bank Digital Currency

CEX: Centralized Exchange

CLT: Cryptocurrency Literacy Test

DAO: Decentralized Autonomous Organization

DeFi: Decentralized Finance

DeSci Decentralized Science

DLT: Distributed Ledger Technology

NFT: Non-Fungible Token

PRISMA-SCR: Preferred Reporting Items for Systematic reviews and Meta-Analyses extension for Scoping Reviews

1 Nakamoto, S. “Bitcoin: A Peer-to-Peer Electronic Cash System.” (2008) https://bitcoin.org/bitcoin.pdf.

2 Buterin, V. “A Next-Generation Smart Contract and Decentralized Application Platform.” (accessed 16 July 2024) https://ethereum.org/en/whitepaper/.

3 Schär, F. “Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets.”Federal Reserve Bank of St. Louis Review 103.2 153–174 (2021) http://dx.doi.org/10.20955/r.103.153-74.

4 Schueffel, P. “DeFi: Decentralized Finance – An Introduction and Overview.” Journal of Innovation Management 9.3 (2021) https://doi.org/10.24840/2183-0606_009.003_0001.

5 Weidener, L., Spreckelsen, C. “Decentralized Science (DeSci): Definition, Shared Values, and Guiding Principles.” Frontiers in Blockchain 7 (2024) https://doi.org/10.3389/fbloc.2024.1375763.

6 CHAISE Consortium. “A Blueprint for Sectoral Cooperation on Blockchain Skill Development.” CHAISE Project (2024) https://chaise-blockchainskills.eu/.

7 Patan, R., Parizi, R. M., Dorodchi, M., Pouriyeh, S., Rorrer, A. “Blockchain Education: Current State, Limitations, Career Scope, Challenges, and Future Directions.” arXiv (accessed 11 April 2025) https://arxiv.org/abs/2301.07889.

8 Themistocleous, M., Christodoulou, K., Iosif, E., Louca, S., Tseas, D. “Blockchain in Academia: Where Do We Stand and Where Do We Go?” Proceedings of the HICSS 2020 5338–5347 (2020) https://doi.org/10.24251/HICSS.2020.656.

9 CHAISE Consortium. “D4.3.1: European Blockchain Skills Strategy.” CHAISE Project (accessed 11 April 2025) https://chaise-blockchainskills.eu/wp-content/uploads/2022/05/CHAISE-European-Blockchain-Skills-Strategy.pdf.

10 Reichert, F., Pan, Q., Chen, L. L. “Digital Literacy Assessment.” UNESCO (2023) https://unesdoc.unesco.org/ark:/48223/pf0000386202.

11 Sato, F. E., Park, J. “A Systematic Review of Climate Change Literacy Assessment Methods.” The Journal of Environmental Education 56.1 65–83 (2024). https://doi.org/10.1080/00958964.2024.2385333.

12 CHAISE Consortium. “The Registry of Blockchain Educational and Training Offerings.” CHAISE Project (2024) https://chaise-blockchainskills.eu/registry-of-blockchain-educational-and-training-offerings/.

13 Reder, S., Davila, E. “Context and Literacy Practices.” Annual Review of Applied Linguistics 25 170–187 (2005) https://doi.org/10.1017/S0267190505000097.

14 Budd, J. M. “Theoretical Foundations for Information Literacy: A Plan for Action.” Proceedings of the Association for Information Science and Technology 51.1 1–5 (2015) https://doi.org/10.1002/meet.2014.14505101001.

15 Lintner, T. “A Systematic Review of AI Literacy Scales.” npj Science of Learning 9.50 (2024) https://doi.org/10.1038/s41539-024-00264-4.

16 Ng, D. T. K., Leung, J. K. L., Chu, S. K. W., Qiao, M. S. “Conceptualizing AI Literacy: An Exploratory Review.” Computers and Education: Artificial Intelligence 2 100041 (2021) https://doi.org/ 10.1016/j.caeai.2021.100041.

17 Chiu, T. K. F. et al. “Developing and Validating Measures for AI Literacy Tests: From Self-Reported to Objective Measures.” Computers and Education: Artificial Intelligence 7 100282 (2024) https://doi.org/10.1016/j.caeai.2024.100282.

18 Kabashi, F., Snopce, H., Aliu, A., Luma, A., Shkurti, L. “A Systematic Literature Review of Blockchain for Higher Education.” In Proceedings of the 2023 International Conference on IT Innovation and Knowledge Discovery (ITIKD) 1–6 (2023) https://doi.org/10.1109/ITIKD56332.2023.10100049.

19 Tricco, A. C, et al. “PRISMA Extension for Scoping Reviews (PRISMA-ScR): Checklist and Explanation.” Annals of Internal Medicine 169.7 467–473 (2018) https://doi.org/10.7326/M18-0850.

20 Jones, M., Truong, L., Binny, S. “Measuring Cryptocurrency Literacy.” SSRN (accessed 11 April 2025) http://dx.doi.org/10.2139/ssrn.4541401.

21 Jones, M., Binny, S., Truong, L. “The Interdependence of Financial Literacy and Crypto Literacy.” SSRN (accessed 11 April 2024) http://dx.doi.org/10.2139/ssrn.4757280.

22 Colombo, J., Yarovaya, L. “Are Crypto and Non-Crypto Investors Alike? Evidence from a Comprehensive Survey in Brazil.” Technology in Society 76 102468 (2024) https://doi.org/10.1016/j.techsoc.2024.102468.

23 Wen, Y.-C., Hongchindaket, A. “Interviewing Young Adults About Cryptocurrency Literacy and Investment Intention.” In Proceedings of the 8th International Conference on Business and Industrial Research (ICBIR) 452-456 (2023) https://doi.org/10.1109/ICBIR57571.2023.10147709.

24 Balutel, D., Engert, W., Henry, C., Huynh, K., Rusu, D., Voia, M. “Crypto and Financial Literacy of Cryptoasset Owners versus Non-Owners: The Role of Gender Differences.” Journal of Financial Literacy and Wellbeing 1 1–27 (2024) https://doi.org/10.1017/flw.2024.2.

25 Khan, M. T. I. “Literacy, Profile, and Determinants of Bitcoin, Ethereum, and Litecoin: Survey Results.” Journal of Education for Business 7 367-377 (2023) https://doi.org/10.1080/08832323.2023.2201414.

26 Hidajat, T., Kristanto, R. S., Octrina, F. “Measuring Bitcoin Literacy in Indonesia.” Journal of Asian Finance, Economics and Business 8.3 433–440 (2021) https://doi.org/10.13106/jafeb.2021.vol8.no3.0433.

27 Khasanovich, M. M., Zaurovich, A. Z., Mikhailovich, K. D., Anatolevich, G. I., Ivanovna, V. Z. “Case Study of Youth Financial Literacy in the Field of Cryptocurrency Use.” In D. K. Bataev (Ed.) European Proceedings of Social and Behavioural Sciences 92 3153-3165 (2020) https://doi.org/10.15405/epsbs.2020.10.05.419.

28 Bannier, C., Meyll, T., Röder, F., Walter, A. “The Gender Gap in ‘Bitcoin Literacy.’” Journal of Behavioral and Experimental Finance 22 129-134 (2019) https://doi.org/10.1016/j.jbef.2019.02.008.

29 Dos Santos, S., Singh, J., Thulasiram, R. K., Kamali, S., Sirico, L., Loud, L. “A New Era of Blockchain- Powered Decentralized Finance (DeFi) – A Review.” In 2022 IEEE 46th Annual Computers, Software, and Applications Conference (COMPSAC) 1286-1292 (2022) https://doi.org/10.1109/COMPSAC54236.2022.00203.

30 Kabashi, F., Snopce, H., Aliu, A., Luma, A., Shkurti, L. “A Systematic Literature Review of Blockchain for Higher Education.” In Proceedings of the 2023 International Conference on IT Innovation and Knowledge Discovery (ITIKD) 1-6 (2023) https://doi.org/10.1109/ITIKD56332.2023.10100049.

31 Frizzo-Barker, J., Chow-White, P., Adams, P., Mentanko, J., Ha, D., Green, S. “Blockchain as a Disruptive Technology for Business: A Systematic Review.” International Journal of Information Management 51 (2020) https://doi.org/10.1016/j.ijinfomgt.2019.10.014.

32 Schneiderhan, J., Guetterman, T., Dobson, M. “Curriculum Development: A How-To Primer.” Family Medicine and Community Health 7.2 (2019) https://doi.org/10.1136/fmch-2018-000046.

33 Wu, P. P., et al. “Courses of Blockchain Technology to Teach at a Career-Oriented College.” Journal of Computing Sciences in Colleges 34.3 127 (2019). https://dl.acm.org/doi/abs/10.5555/3306465.3306483.

34 Coinme, CoinDesk, MoneyGram. “Crypto Literacy Quiz.” CryptoLiteracy.org (2023) https://cryptoliteracy.org/quiz/.

35 No Author. “The Merge.” Ethereum Foundation (accessed 13 July 2024) https://ethereum.org/en/roadmap/merge/.

36 European Securities and Markets Authority (ESMA). “Consultation Paper on the Guidelines for the Criteria on the Assessment of Knowledge and Competence under the Markets in Crypto Assets Regulation (MiCA).” ESMA35-1872330276-2004 (2005) https://www.esma.europa.eu/sites/default/files/2025-02/ESMA35-1872330276- 2004_MiCA_-_Consultation_Paper_-_Guidelines_on_knowledge_and_competence.pdf.

Correct answers are marked with *

A time-stamped record of transactions that cannot be modified or deleted without the consensus of the network participants*

A decentralized database of transactions that can only be used for financial services

A record of transactions stored in a time-stamped sequence of files, which all contain the same information

A decentralized database of transactions that can only be accessed at certain times set by the network participants

Control by a single entity

Distribution of control and decision-making across networks*

Storage of data at a central location

Use of private servers

A private database for storing transactions that is accessible only to authorized individuals

A publicly accessible record of transactions on a blockchain*

A record of transactions kept by financial institutions

A book for manual entry of transactions

By central authorities that send information to a centralized server

Through a consensus mechanism involving multiple participants*

By deleting old data

Through a manual process by a single entity

To create a data backup

To ensure that participants agree on the state of the distributed ledger*

To delete older and obsolete transactions from the distributed ledger

To create new blocks randomly

To hack the network

To verify and propagate transactions across the network*

To store cryptocurrencies in a secure and digital vault

To develop new cryptocurrencies

A traditional legal contract stored on paper

A self-executing code that enforces and executes the terms of an agreement based on predefined conditions*

A digital signature for verifying identities

A cryptographic method for deleting transactions

A function that compresses data for physical storage of data

A cryptographic algorithm that converts input data into a fixed-size string of characters*

A method for creating new blocks by sequentially adding validated data without verification

A protocol for securing transactions through encryption

Proof-of-work

Proof-of-stake*

Proof-of-digging

Proof-of-mining

A public identifier used for transactions

A cryptographic code that grants access to and control over blockchain assets*

A physical key used to open a safe with cryptocurrencies

A key used to delete blockchain data

A split in the blockchain network resulting from differing consensus rules*

A method of securely storing private keys within a protected environment

A type of consensus algorithm

A way to compress blockchain data

To create new blocks and validate transactions*

To store private keys

To delete old transactions

To create new cryptocurrencies

A blockchain where only certain authorized participants can validate transactions*

A blockchain where anyone can join and validate transactions

A blockchain without any need for validation, allowing any data to be recorded without verification

A blockchain that operates only within a specific country

A problem related to achieving consensus in a distributed network*

A way to encrypt data that encodes and decodes data to guarantee confidentiality

A method of storing transactions

A type of smart contract

A data structure used for efficient and secure verification of data within blockchain technology*

A tree-planting initiative funded by blockchain companies that aims to enhance environmental sustainability

A cryptographic method for generating new blocks

A type of blockchain consensus mechanism

Correct answers are marked with *

A digital form of currency secured by cryptography*

A physical form of currency that can be exchanged in person

A government-issued digital currency

A traditional banking method

A form of cryptocurrency that operates on a blockchain it is native to*

A digital representation of a physical coin that can be minted by official institutions

A token used in video games

A currency issued by the government

Cryptographic assets that operate on a blockchain they are not native to*

Physical tokens used in arcades

Government-issued digital assets

Another name for coins

Non-Fungible Token*

Non-Financial Transaction

New Financial Technology

Not For Trading

Tokens that confer voting rights on a blockchain network’s governance decisions*

Tokens used to access services within a blockchain

Tokens representing a physical asset

Tokens issued and managed by a central authority or government

Tokens used to access a specific service or product within a blockchain ecosystem*

Tokens representing ownership in a company by giving holders equity-like rights or dividends

Tokens used to govern wallets

Tokens pegged to a stable asset like fiat currency

Cryptocurrencies pegged to a stable asset, such as fiat currency*

Cryptocurrencies used primarily for illegal activities in underground markets

Digital coins used only in video games

Cryptocurrencies that are designed to increase in value rapidly

Both types of cryptocurrencies use a centralized server to process and verify transactions

Both types of cryptocurrencies use a peer-to-peer network to process and verify transactions*

Both types of cryptocurrency transactions are processed and verified by a consortium of financial institutions

Both types of cryptocurrency transactions are processed and verified by a group of government agencies

Fees paid to process and validate transactions*

Fees paid to the government for using cryptocurrency

Fees paid join a cryptocurrency exchange

Fees paid to store cryptocurrency in a wallet

Transactions are always anonymous and cannot be traced back to the sender

Transactions are anonymous only if they are signed by a hardware wallet

Transactions are usually anonymous, but it may be possible to trace them back to the sender through blockchain analysis and interactions in the real world*

Transactions must include the sender’s country of origin in order to be validated

Anyone who runs software that implements the Bitcoin protocol*

Only Bitcoin developers

Only those who receive a license from a state or regulatory agency

Only those who own bitcoin

Satoshi*

Bit

Microbitcoin

Millibitcoin

CBDCs are digital currencies used only between different countries’ central banks.

CBDCs are physical currencies issued by central banks, like bank notes or coins

CBDCs are digital currencies issued by central banks*

CBDCs are investment funds that guarantee a return

An online platform that facilitates the trading of cryptocurrencies and is controlled by a central authority*

A decentralized platform for peer-to-peer trading of cryptocurrencies that eliminates intermediaries and central oversight

A physical location for trading cryptocurrencies

A government-regulated exchange for fiat currencies

An online platform for peer-to-peer trading of cryptocurrencies without a central authority*

A platform controlled by a central authority

A government-regulated exchange

A physical location for trading cryptocurrencies